Explore the Future: Key Investment Trends to Watch in Q1 2024

- Elena from PARTNER2B

- Apr 20, 2024

- 3 min read

PARTNER2B has reviewed the first-quarter investment trend analysis from Tech EU, identifying key trends that could capture your interest.

Q1 of 2024 has seen an exciting boost in European investments, especially within the clean technology (cleantech) sector. There's been a noticeable increase in interest and investment in cleantech, positioning it as a key area for investors. This surge signifies a strong focus on sustainable and environmentally friendly technologies, highlighting its importance in the investment landscape.

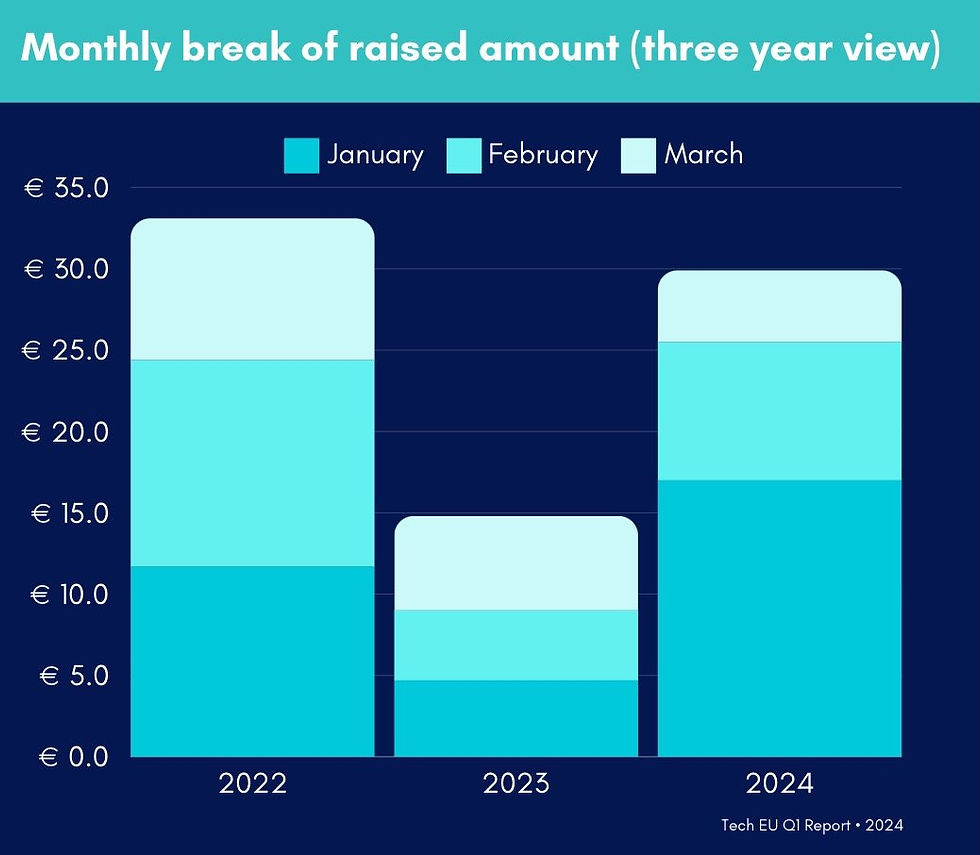

Total Funds Raised in the First Quarter Across Three Years

The first quarter of 2024 witnessed a promising rise in European investment trends, mirroring the early 2022's positive vibe but with larger individual investments. This means that although the number of deals is similar to before, the quality and size of the projects receiving funding have significantly improved.

In the early months of 2024, both new and established companies received significant financial support through large loans. A key highlight of this time was the considerable investment in cleantech ventures. This not only shows increased financial backing for sustainable technologies but also progress in product development and market growth.

In Q1 2024, European tech companies had an impressive start, raising €29.9 billion through 970 deals. This was a significant increase from the €14.7 billion raised in the first quarter of the prior year. However, it was still 10% less than the €33.1 billion they secured in the same timeframe in 2022.

In the first quarter of 2024, European tech companies experienced a significant surge in fundraising, showcasing a strong recovery from the previous year. With a total of €29.9 billion raised, this marks a substantial increase from the €14.7 billion recorded in the first quarter of 2023.

Despite this impressive growth, the figures fell short of the €33.1 billion peak reached in the first quarter of 2022. This trend highlights the robust investment momentum within the European technology sector, indicating a vibrant and thriving ecosystem for startups and established tech firms alike.

Funds Raised by Country

Sweden is leading the way in green technology, a significant development for startups, founders, and fintech companies. This trend towards sustainable innovation opens up new opportunities for growth and collaboration within the eco-friendly tech sector.

In Q1 2024, Sweden became a top investment destination, drawing €12.3 billion in 52 deals, mainly due to greentech advancements, including Northvolt's expansion and H2 Green Steel's facility financing.

France followed with €5.7 billion from 80 deals, while Germany led in deal volume, securing 160 deals worth €3.6 billion. The UK and the Netherlands also stood out, bringing in €3.5 billion across 213 deals and €1.2 billion in 72 deals, respectively.

Sweden's drive for trends in green technology and sustainability shines in initiatives like Northvolt's battery production and H2 Green Steel's project. These efforts not only enhance Sweden's reputation in the eco-tech sector but also establish it as a strong global competitor, even challenging the US with Electra's green steel factory launch.

Sweden's focus on sustainability leadership shows its potential to lead the global market towards a more sustainable future.

Investments Drawn by The Industry

In Q1 2024, the cleantech industry led the investment trends scene, securing an impressive €12.4 billion through 67 deals. This highlights the sector's growing impact and potential for entrepreneurs and startups in green technology. Cleantech startups dominated investment activity, with five firms raising a total of €12 billion.

During this period, other sectors saw significant investments too. The transportation sector stood out with €6.3 billion in funding, showing high investor interest in advanced mobility solutions. Similarly, the fintech industry drew €2.6 billion in investments, proving its attractiveness to investors looking to leverage disruptive financial technologies.

Software topped deal volume with 138 transactions, underlining the sector's explosive growth, partly fueled by generative AI advancements that are transforming business, creativity, and automation.

Healthtech and fintech also performed well, showing the vast opportunities for startups innovating in digital health and finance.

Conclusion

The exponential growth of generative AI technologies is ushering in remarkable transformations within the software industry, fueling a surge in strategic partnerships and investments across different domains. This dynamic shift is notably impacting enterprise solutions, creative sectors, and the realm of business automation.

For entrepreneurs, emerging startups, and visionary CEOs, particularly those navigating the fintech landscape, leveraging AI-driven software solutions represents a pivotal opportunity to spearhead innovation and maintain a competitive edge. In the context of the fast-paced market dynamics of today, integrating artificial intelligence into software development processes is becoming increasingly indispensable for securing leadership positions.

This trend is poised to be one of the key investment trends of Q1 2024, signaling a prime window for founders, startups, and CEOs in the fintech sector to capitalize on the potential of AI-fueled technologies. Engaging with these innovations now can set the stage for significant strategic advantages, allowing businesses to stay ahead in an evolving digital ecosystem.

Source: Tech EU

Comments